colorado electric vehicle tax credit 2019

The tax credit for most innovative fuel. A tax credit is available for the purchase of a new qualified PEV that draws propulsion using a traction battery that has at least five kilowatt-hours kWh of capacity uses an external source of energy to.

How Do Electric Car Tax Credits Work Credit Karma

Unused tax credit can be rolled forward to future years.

. Trucks are eligible for a higher incentive. Therefore you will receive the benefit of the full 5000. Alongside a federal tax credit of 7500 Colorado residents are able to claim an additional state credit of 5000 at point of sale when they buy an EV.

If a single person purchases two eligible plug-in electric vehicles with tax credits up to 7500 for each vehicle they should be able to claim 15000 in. For additional information consult a dealership or this Legislative Council Staff Issue Brief. For information on how to access forms to apply for the tax credits click here.

No credit is allowed for the purchase or lease of a used. Qualifying vehicle types include electric vehicles plugin hybrid electric vehicles liquefied petroleum gas LPG vehicles and compressed natural gas CNG vehicles. EV charging stations are being rapidly installed throughout our state and country.

Colorado allows an income tax credit to taxpayers who have purchased an alternative fuel vehicle converted a motor vehicle to use an alternative fuel or have replaced a vehicles power source. Together these incentives significantly reduce the cost of buying an electric vehicle more than 40 percent in some cases. Qualified EVs titled and registered in Colorado are eligible for a tax credit.

As a plug-in electric vehicle PEV purchaser you are eligible for up to 7500 in Federal and 6000 in Colorado tax credits. 2500 in state tax credits and up to 7500 in federal tax credits. The new proposed reform would have.

As a plug-in electric vehicle PEV purchaser you are eligible for up to 7500 in Federal and 6000 in Colorado tax credits. November 17 2020 by electricridecolorado. Skip the Gas Station.

This includes all Tesla models and Bolts that do not receive the Federal tax incentive. Tax credits are available in Colorado for the purchase lease and conversion of light medium and heavy duty alternative fueled vehicles electricEV plug-in hybrid or PHEV compressed natural or CNG liquefied natural gas or LNG liquefied petroleum gas or LPG and hydrogen These credits were simplified effective Jan. Colorado residents are able to claim an additional state tax credit of 2500 when they buy an electric vehicle.

Under the bill the tax credit for a passenger electric or plug-in hybrid vehicle would drop from the current 5000 after the first year to 4000 and. Save time and file online. Electric Vehicle EV Tax Credit.

Fiscal Policy Taxes. If you claim the colorado electric vehicle tax credit for yourself you need to file a colorado income tax return form dr 0617 and a copy of the lease or purchase agreement. As of 2021 Colorado offers a vehicle-related incentive for new EVs light passenger vehicles up to 2500.

You do not need to login to Revenue Online to File a Return. Right now you can get a 4000 tax credit in Colorado for the purchase or lease of ANY new all-electric vehicle and qualifying plug-in hybrid electric vehicles. The Colorado General Assemblys 2019 and 2021 legislative sessions were monumental for climate and.

The act modifies the amounts of and extends the number of available years of the existing income tax credits for the purchase or lease of an electric motor vehicle a plug-in hybrid electric motor vehicle and an original equipment manufacturer electric truck. In addition to cutting-edge technology and performance state and federal tax credits are helping to make buying an electric vehicle EV an even smarter choice. 1500 for 2-year minimum leases.

Alongside a federal tax credit of 7500 Colorado residents are able to claim an additional state credit of. 2500 credit received with state income tax refund may be applied at purchase with many electric vehicle manufacturers. Colorado electric vehicle tax credit 2019 Saturday March 5 2022 Edit.

Vehicle Conversion 1 and 1A Electric Vehicle or Plug-in Hybrid Electric Vehicle Light Duty Passenger Vehicle 5000 2500 5000 7 and 7A Electric Truck or Plug-in Hybrid Electric Truck Less than or equal to 10000 pounds 7000 3500 7000 Greater than 10000 pounds but less than or equal to 26000 pounds 10000 5000 10000. Its also one of the few battery-powered luxury SUVs on the market. You may use the Departments free e-file service Revenue Online to file your state income tax.

Colorado allows an income tax credit to taxpayers who have purchased an alternative fuel vehicle converted a motor vehicle to use an alternative fuel or have replaced a vehicles power source with an alternative fuel power source. There is also a federal tax credit available up to 7500 depending on the cars battery capacity. The Colorado Innovative Motor Vehicle Credit is entered on line 22 of your Colorado Form 104 and is subtracted from line 15 your net Colorado income tax.

Eligible Vehicles for Tax Credit. The Colorado General Assemblys 2019 and 2021 legislative sessions were monumental for climate and. Together these incentives significantly reduce the cost of buying an electric vehicle more than 40 percent in some cases.

To accelerate the electrification of cars buses trucks and other vehicles in Colorado the state set a goal of 940000 electric vehicles on the road by 2030Governor Jared Polis issued an Executive Order Supporting a Transition to Zero Emission Vehicles in January 2019. The credit is worth up to 5000 for passenger vehicles and more for trucks. Income tax - credit - innovative motor vehicles.

And improve the safety of Colorados transportation network. I am completing Form 8936 for a 2019 Tesla purchase to receive the electric vehicle credit. Light-duty EVs purchased leased or converted before January 1 2026 are eligible for a tax credit equal to the amounts below per calendar year.

Why buy an Electric Vehicle. If your total subtractions lines 16-23 exceed your net CO income tax you will be refunded. Vehicle Conversion 1 and 1A Electric Vehicle or Plug-in Hybrid.

After you file you have the option of setting up a Login ID and Password to view your income tax account in Revenue Online. Income tax - credit - innovative motor vehicles. The tax credit for most innovative fuel.

Check em all out and map your route. Trucks are eligible for a higher incentive. A number of bills affecting electric vehicle adoption in Colorado were considered during the 2019 session.

Examples of electric vehicles include.

Tesla Inc And The World S Transition To Electric Vehicles Risks Strenghts Opportunities And Strategic Reccommendations Grin

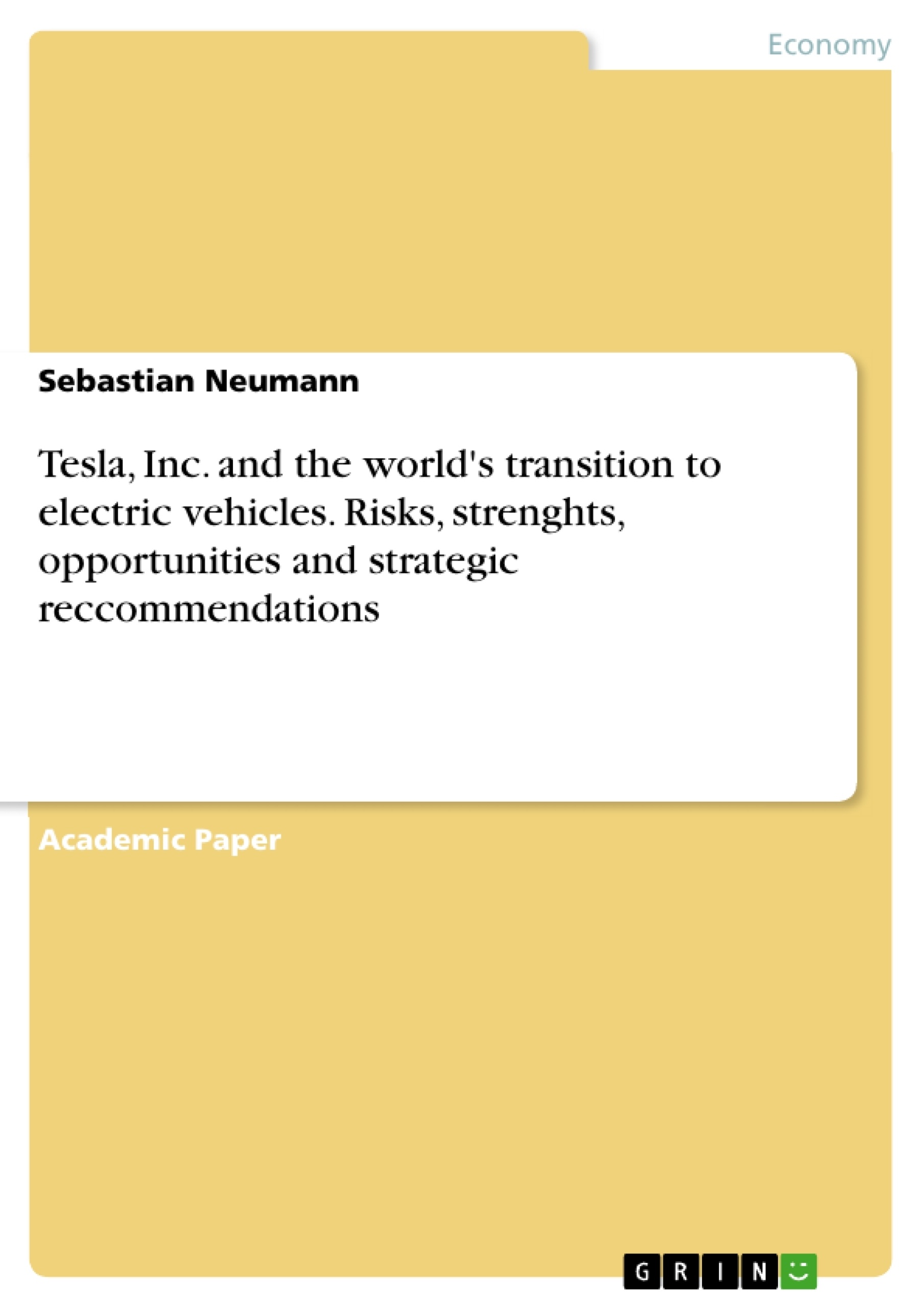

Which Incentives Are Driving Electric Vehicle Adoption

A Complete Guide To The Electric Vehicle Tax Credit

A Breakdown Of The Us Ev Market By State Shows More Incentives Equals More Sales Jato

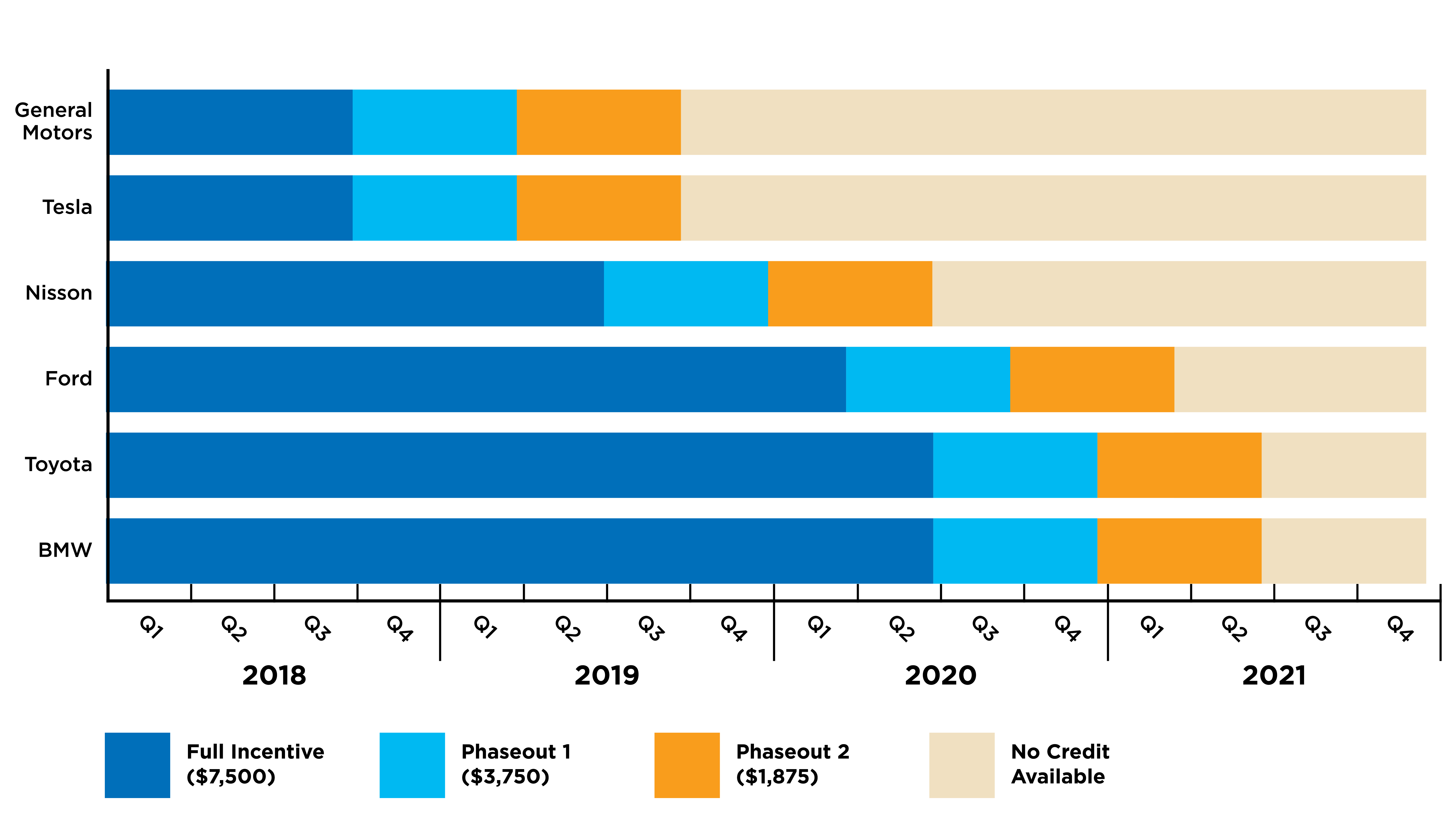

Best Electric Vehicle Charging Companies Off 61

How To Claim An Electric Vehicle Tax Credit Enel X

2021 Audi Q4 E Tron Interior Specs Price Audi Tron Audi Q4

Tax Credits Drive Electric Northern Colorado

A Breakdown Of The Us Ev Market By State Shows More Incentives Equals More Sales Jato

Electric Car Electric Bill Off 61

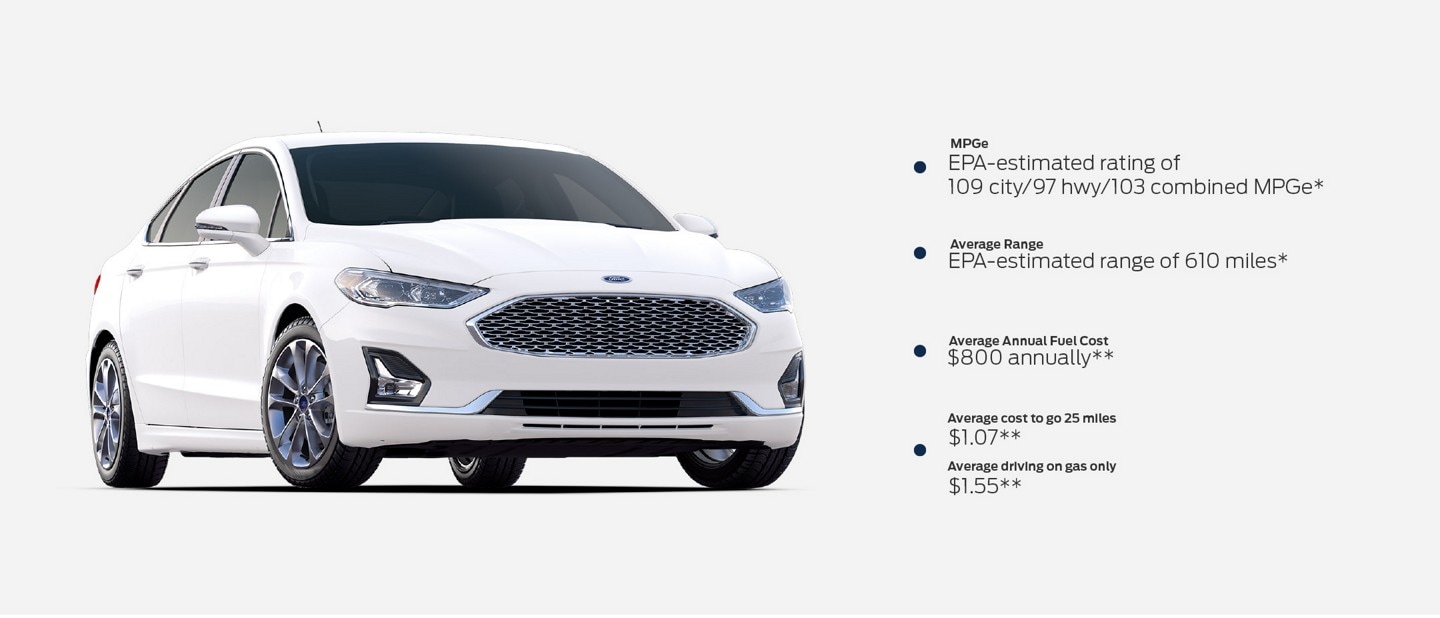

Ford Plug In Hybrid Electric Vehicles Adapt On The Go In A Phev

Electric Cars The Surge Begins Forbes Wheels

When An Out Of Warranty Ev Fails Who You Gonna Call Https T Co Vxcylubpib By Bradberman Bjmt Best Gas Mileage Mercedes Benz Benz S Class

Updated 17 States Now Charge Fees For Electric Vehicles Greentech Media

The Surge Of Electric Vehicles In United States Cities International Council On Clean Transportation